|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

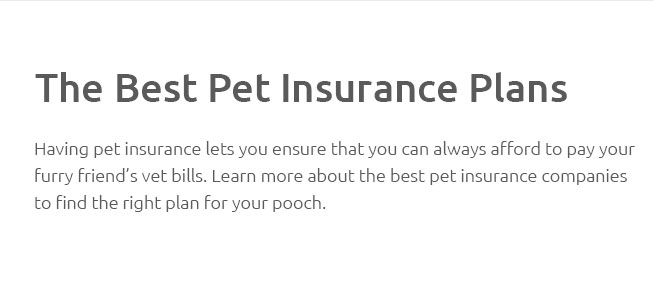

Comparing Prices for Multi-Pet Insurance: A Comprehensive GuideAs more households embrace the joys of multi-pet ownership, the demand for multi-pet insurance has surged, offering a safety net that promises financial protection and peace of mind. Navigating this landscape can be daunting, given the plethora of options available. Understanding the nuances of multi-pet insurance is crucial for pet owners aiming to make informed decisions that align with their unique needs and circumstances. Why Consider Multi-Pet Insurance? For families with multiple pets, individual insurance policies for each furry friend can quickly become financially burdensome. Multi-pet insurance provides a streamlined, often more economical solution by bundling coverage for all pets under a single policy. This not only simplifies the management of policies but can also lead to significant cost savings. The Pros of Multi-Pet Insurance

The Cons of Multi-Pet Insurance

Price Comparison Strategies Conducting a thorough price comparison is an essential step in securing the best deal on multi-pet insurance. Start by identifying your priorities-whether it's lower premiums, extensive coverage, or flexibility. Utilize online comparison tools to gather quotes from various providers, ensuring a comprehensive overview of the market. Be mindful of factors such as deductibles, reimbursement rates, and annual limits, as these can significantly impact the overall cost and value of the policy. Additionally, scrutinize the fine print to understand the exclusions and restrictions, as these can vary significantly between insurers. Engaging with customer reviews and ratings can provide insights into the insurer's reputation and service quality, helping you make a more informed decision. Subtle Opinion While multi-pet insurance is not without its drawbacks, its benefits in terms of cost savings and convenience often outweigh the potential downsides, especially for those with several pets. However, it is imperative to remain vigilant about the specifics of the policy to avoid any unwelcome surprises down the line. Conclusion In the realm of multi-pet insurance, a well-considered approach to comparing prices and coverage options is key. By weighing the pros and cons and engaging in diligent research, pet owners can find a policy that provides optimal protection for their cherished companions. Frequently Asked QuestionsWhat factors should I consider when comparing multi-pet insurance policies?When comparing multi-pet insurance policies, consider factors such as the premium cost, coverage limits, deductibles, exclusions, and whether the policy includes discounts for additional pets. Assess the insurer's reputation and customer service reviews as well. Is it cheaper to insure multiple pets under one policy?Yes, insuring multiple pets under one policy is generally cheaper due to discounts offered for additional pets, making it a cost-effective solution compared to individual policies for each pet. Can I customize a multi-pet insurance policy for each pet?Customization can be limited in multi-pet policies. While some insurers offer options to tailor coverage for each pet, others may provide a more standardized plan. It’s important to verify the level of customization available with the insurer. What are common exclusions in multi-pet insurance policies?Common exclusions may include pre-existing conditions, certain hereditary conditions, and specific breeds. Each policy varies, so it’s crucial to read the terms carefully to understand what is not covered. How can I ensure my multi-pet insurance claim is processed smoothly?To ensure a smooth claim process, keep detailed records of veterinary visits and treatments, understand your policy's coverage, and submit complete documentation promptly. Communicating with your insurer for any clarifications can also aid in a hassle-free experience. https://www.petinsurance.com/pet-insurance/multiple-pets/

Find the best choice for your family. Whether you have two cats, three dogs, or a household full of rabbits and reptiles, we have plans you can customize for ... https://www.businessinsider.com/personal-finance/pet-insurance/best-multi-pet-insurance-companies

Best Multi-Pet Insurance - Best for Unlimited Coverage: Figo Pet Insurance - Best for Customizability: Lemonade Pet Insurance - Best for Seniors: Pumpkin Pet ... https://www.confused.com/pet-insurance/multi-pet

Compare multi-pet insurance quotes for your beloved pets. Get a pet quote. Compare quotes for up to 7 pets. Combining policies for your pets means less ...

|